Wow, there's a lot to unpackage here.

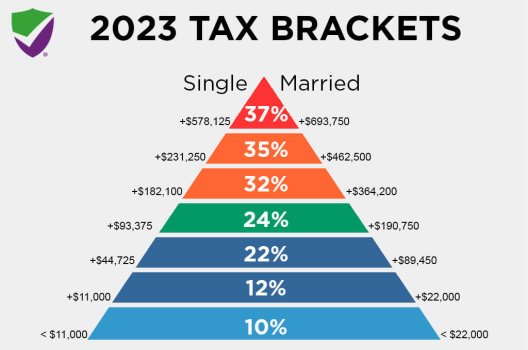

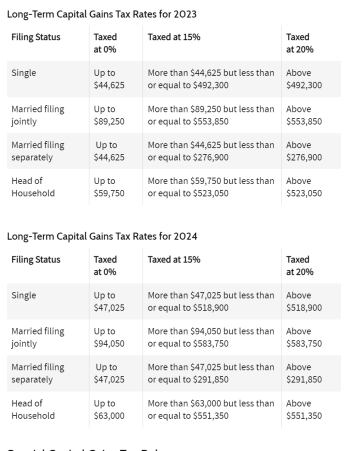

A: Absolutely the wealthy and corporations don't pay their "fair share". You're confusing sales tax with income tax. Yes, they pay the same sales tax that we all do. But income tax? If you don't work a regular 9 to 5 job like any working schmuck you don't pay income tax. The biggest income tax loophole is the definition of income. For most people, what counts as income is simple to see—it’s their salary, and maybe, if they’re lucky, a bonus. Yet for the very wealthy, salary is trivial—if they earn one at all. That’s not where their riches come from.

Then there's the "Charity" loophole, the Insurance loophole, the list friggin goes on and on how the wealthy have crafted the system to their favor.

See:

Unlike the offshore account tax fraud that gets so much press and regulatory attention, many of the most egregious tax avoidance scams are perfectly legal.

truthout.org

Financial Tips, Guides & Know-Hows

livewell.com

Compare the ordinary income tax bracket to the long term capital gains tax bracket. See the difference? This didn't happen by chance.

View attachment 4827

View attachment 4828

A: Yes, the debt will never be paid. What we do need though, and don't have, is a balanced budget. Primarily the best way to deal with it is to roll back the tax cuts. Giving large tax cuts to the wealthy and corporations does nothing to control the debt, it only exacerbates the problem. The true cause of rising debt is not excessive spending but reduced federal income. "In fact, relative to earlier projections, spending is down, not up. But revenues are down significantly more. If not for the Bush tax cuts - and their extensions - as well as the Trump tax cuts revenues would be on track to keep pace with spending indefinitely, and the debt ratio (debt as a percentage of the economy) would be declining. Instead, these tax cuts have added $10 trillion to the debt since their enactment and are responsible for 57 percent of the increase in the debt ratio since 2001, and more than 90 percent of the increase in the debt ratio if the one-time costs of bills responding to COVID-19 and the Great Recession are excluded. Eventually, the tax cuts are projected to grow to more than 100 percent of the increase."

Source:

https://www.americanprogress.org/ar...ly-responsible-for-the-increasing-debt-ratio/

A: Easier said than done. The military industrial complex is so engrained into our economy there's no weening ourselves off that tit.

Income from Gas tax revenue stopped keeping up with the expenses it was supposed to cover in the early 1970s. Since 1993, when the federal gas tax was first parked at 18.4 cents, inflation and rising construction costs have eroded its effectiveness as a transportation-related revenue source. In addition, U.S. vehicles have grown more fuel-efficient overall – which means Americans use less fuel for every mile they drive, hence less gas tax revenue. Now, we throw EV's into the mix and the problem only gets worse.

Source:

https://www.pbs.org/newshour/politi...ows-how-hard-it-is-to-fund-new-infrastructure

If you think police corruption is bad now privatization of police and for-profit policing would be even worse. Airport security prior to 9/11 was privatized and went to the lowest bidder. You know where that got us.

Privatized fire protection for only those who can afford it is just as bad an idea as privatized policing.

I’m not confusing sales tax and income tax. I am precisely saying that an income tax that varies in dollar terms based on the quantity of dollars you make is the very antithesis of fair. What is fair is that everyone pay for the services they consume and not for the services they don’t consume. If the services apply to everyone equally, then everyone should pay the same dollar amount for said services. So if the military costs $300B, and there are $300M people, everyone has to cough up $1000. Since taxation is theft, the concept of coming up with a fair way to steal from everyone is a bit of a mind-fuck for me, but I would say that would approximate the most fair way I can think of doing it. So just as a gallon of milk costs $4, and a Tesla costs $100k, and a particular house costs $500k, if the military costs $1000 per person living in the US, there is nothing fair about charging some people $100k, and some people $1000, and some people $10, and some people nothing. It sounds nice to say that it is fair because the billionaire can afford more, but we don’t use this method for any privately supplied good or service in history precisely because it is absurd on its face, and if everyone wasn’t indoctrinated with this concept from an early age, I think it would be much easier to see. Just imagine if everything you bought was priced as a percentage of your income? And imagine further if everything got more expensive the more money you made. It is a complete subversion of the concept of money and costs and prices and trade, and it isn’t hard to see that there is nothing fair about it, and in that world where productivity is disincentivized harshly, it wouldn’t be long before everyone stopped working and all goods and services ceased to exist. This is one of my major problems with the concept of democracy is that it incentivizes the many to steal from the few, and over time people try to rationalize to themselves why this theft is first a necessary evil, then justified, then ok, and finally virtuous. If we believe in one person one vote, then it should correspond one vote, one equal share of the bill for all the stuff you vote into existence. And if you think I’m crazy about that, I won’t even get into all the issues with capital gains taxes, but suffice it to say I view their very existence as even more offensive than the graduated income tax.

As far as debt and budgets, yes a budget should be balanced, but just like your budget at home, it must be balanced from both sides. If you lost your job, you would have to cut back on your expenses until you found a new one. If the new job didn’t pay as much as the old one, you would have to make some long term plans about what things in your life you can do without. It would suck, but it would be dealing with reality. But if you came home and said “Honey I lost my job, but it’s OK cause I got a job delivering pizzas, so I bought myself a lambo!” we would all agree that would be insane. That is basically what the government is doing, over and over again, and Democrats say the pizza place needs to pay more so I can afford my lambo, and Republicans say “hey if I stop paying the mortgage I can afford my lambo!”, but sooner or later, that lambo is going to have to go, and the longer you live in this delusion that you can fix this problem and keep your lambo, the harder the fall is going to be.

For the gas and registration fees, if they are not keeping up with the costs, then maybe they need to be raised, however that should be a dedicated fund that is used only for the highway infrastructure, not just put into the general pot to be pissed away. I don’t know all the details of the accounting on that, but it doesn’t surprise me in the least that there would be a shortfall given the more fuel efficient vehicles and electric cars. I doubt that the electric cars are a significant enough percentage of all cars on the road to sway the results by much, but it does throw a wrench into the works as they are very heavy and cause more wear and tear on the road surface, yet use no fuel. For a long time, the gas tax was pretty much the only tax that made sense to me since heavier vehicles tended to cause more wear and tear and also used more fuel, so it worked out as a nice proxy to associate the wear you caused with the amount you paid, but if electric cars continue to become more popular, we may have to go back to the drawing board on that one.

Private security is already a much larger industry than police forces worldwide, and you hardly ever hear of roving gangs of private security guards fleecing people on the side of the road, or shooting innocent unarmed people, or covering up for other private security guards who are caught doing illegal things. In short, your fear-mongering argument that private security forces will be more corrupt than government police not only has no merit, but is demonstrably false.

Fire: yes I seek to ask asset holders to bear the burden of paying for the protection of said asset, instead of offloading that cost onto everyone, including people who have never and will never even own a home. Boo-hoo, the poor homeowner can’t afford $100/month to protect his $500k investment, or whatever the numbers will work out to. Give me a break! By the way, I would also be just fine with the fire department presenting the homeowner with a bill for services rendered while his home is smoldering, but aside from being a bad look for kicking a man when he is down, there would likely be collection issues associated with that practice, so I suspect a subscription type model would evolve as the preferred way of funding fire fighters in the absence of government, but I could be wrong. But using this argument, why should we have any service contracts or insurance at all? Just have the government take it over. Don’t buy a home security system! Security only for those who can afford it? Ban all private home security contracts and make everyone depend on the police! After all, that’s fair! Same goes for pest control too, right? Only pest-free homes for those who can afford it! I mean if the poorest of us have to wake up with rats and cockroaches in their home, why should you get to get rid of them just cause you can afford it? No need for homeowners insurance, let the government take care of it and offload the costs to taxpayers. Might as well get rid of car insurance too! Bump into a car in the parking lot? Don’t do the right thing and leave your information to pay for the damages! You pay your taxes, the government should cover the repairs! I mean they already did such a great job when they got involved in medical insurance, right? I mean now that it is subsidized by taxpayers, medical insurance is cheaper than ever, right?

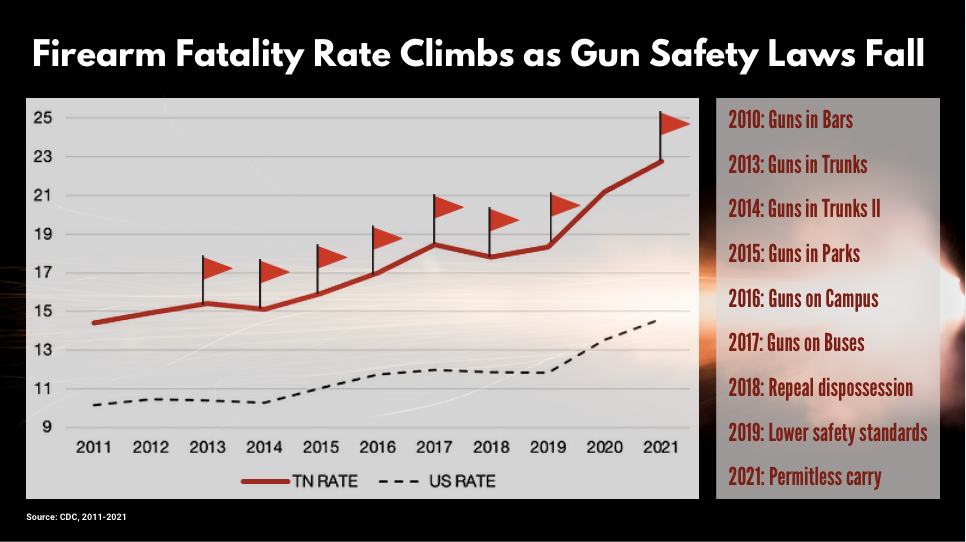

tnsenatedems.medium.com

tnsenatedems.medium.com